how long does coverage normally remain on a limited-pay life policy

With a limited pay life policy you pay your premiums in full within a set number of years. As a general rule of thumb fewer years results in a higher annual premium.

What Is Whole Life Insurance Cost Types Faqs

At that time you should notify.

. When choosing the limited pay whole life option the payment length must be determined at the initial purchase of the policy. With a limited pay whole life insurance policy you pay premiums for only a specific amount of time. All whole life insurance is designed to reach maturity at the insureds age.

How Long Does the Coverage Last on a Limited Pay Life Policy. That being said certain life insurance providers put limits on the length of coverage for limited pay life insurance policies. Also know how long does the coverage normally remain on a limited pay life policy.

A whole life policy generally requires premium payments for your entire life unless you opt to use the cash value to pay for premiums at some point. Limited pay policies are usually whole life insurance policies that schedule premium payments over a finite period. Limited Pay Life policies such as LP65 and 20-Pay Life are variations of Whole Life or Straight Life.

Limited PAY Whole Life means you pay it for 1020 years and the payment stops but the coverage lasts to maturity. What is Limited Pay Life Insurance. How long does coverage remain on a limited pay life policy.

How long does the coverage last on a. Premiums are payable for 10 15 or 20 years depending on the. Premiums are typically paid over the first 10 to 20 years.

Rather than paying premiums forever you choose a set amount of coverage and pay it off within a specific. Once the years have passed you will no longer owe your insurance company premium. Another feature that sets a limited pay life insurance policy apart from the competition.

Fortunately there is a way around that with limited-pay life insurance. For example lets say you buy a whole life insurance policy at age 40. For example limited pay life insurance contracts may.

On older policies that could be as low as age 95. Premiums on limited payment life insurance are paid for a limited number of years but the benefits last a. Term and Whole Life Insurance.

Usually the rates of limited pay whole life policies are paid during a 10 to 20 year period. The quick answer to the question How Long Does Coverage Normally Remain on a Limited Pay Life Policy is. Trusteed For Over 100 Years.

This type of life insurance. Premiums on limited payment life insurance are paid for a limited number of years but the benefits last a lifetime. Life Insurance Coverage In 3 Easy Steps.

Incremental limited pay life insurance policies between 10 and 30 years can be customized depending on when you want to stop paying into your policy. The coverage period for limited pay life policies is often a source of confusion. Depending on the terms you make payments.

Ad Life Insurance For Ages 18 to 85. From 15 A Month. The shorter the pay.

Life Insurance Coverage Is Necessary

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

Guaranteed Issue Life Insurance Policies Fidelity Life

What Is Limited Pay Life Insurance Paradigm Life Insurance

Limited Pay Life Insurance Everything You Need To Know

How Hybrid Life Insurance Pays For Long Term Care Forbes Advisor

Limited Pay Life Insurance Everything You Need To Know

Life Insurance Guide To Policies And Companies

7 Facts You Need To Know About Birth Control And Costs

Guaranteed Issue Life Insurance Policies Fidelity Life

What Is Whole Life Insurance Cost Types Faqs

What Is A 10 Year Term Life Insurance Policy

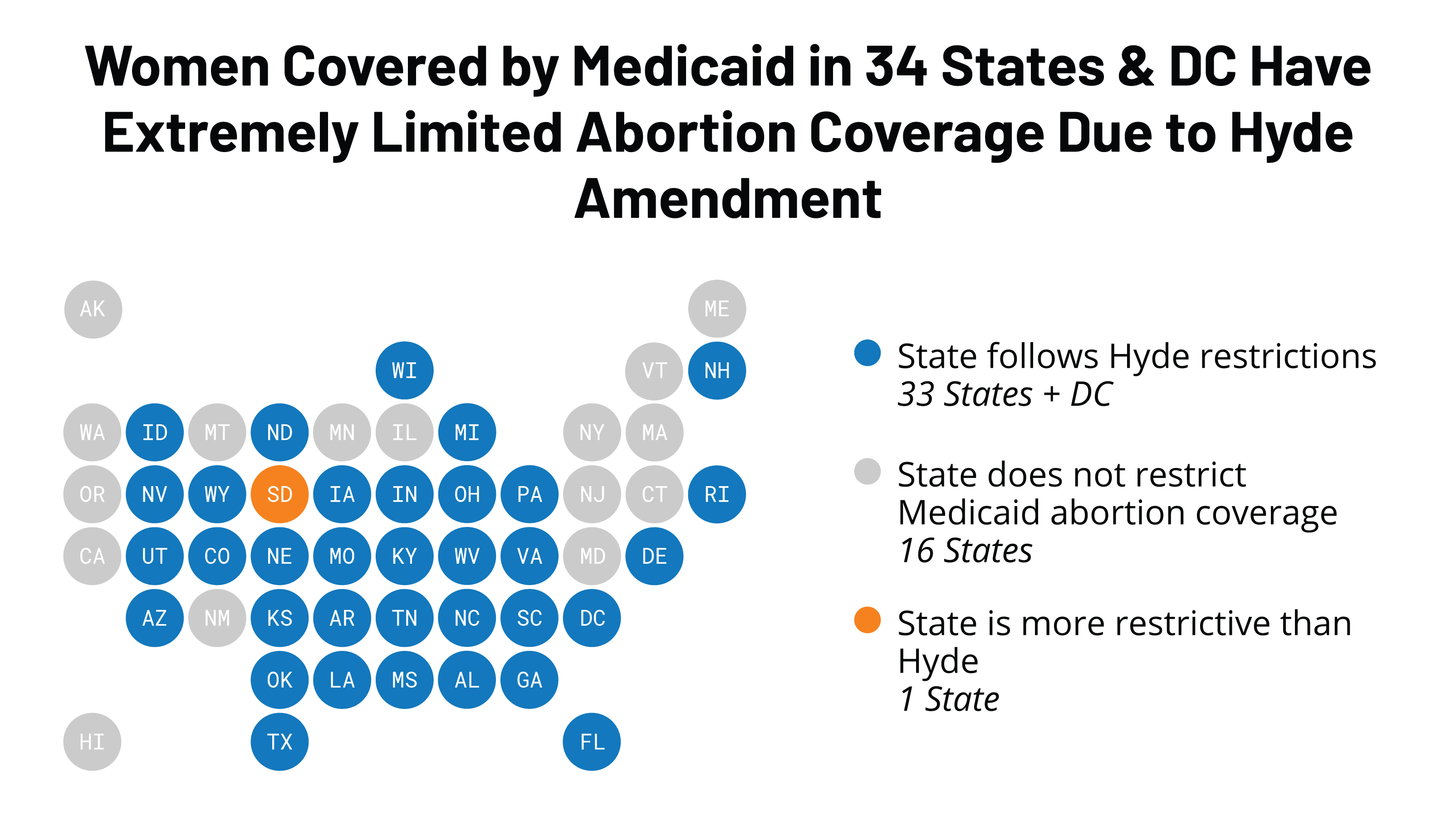

The Hyde Amendment And Coverage For Abortion Services Kff

Limited Pay Life Insurance Everything You Need To Know

2022 Final Expense Insurance Guide Costs For Seniors

What Is Limited Pay Life Insurance Paradigm Life Insurance

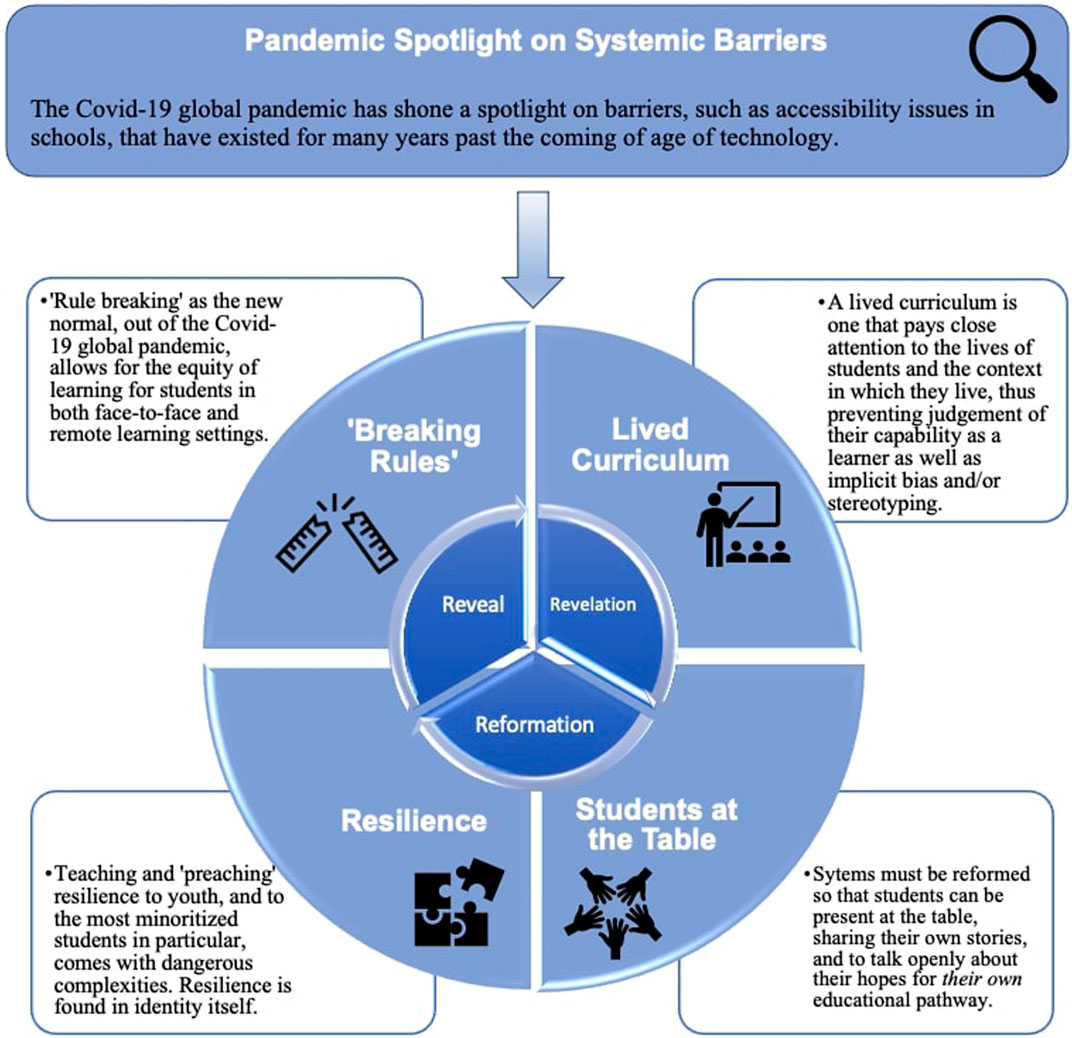

Frontiers Narratives Of Systemic Barriers And Accessibility Poverty Equity Diversity Inclusion And The Call For A Post Pandemic New Normal Education